First Class Info About How To Buy A Call Spread

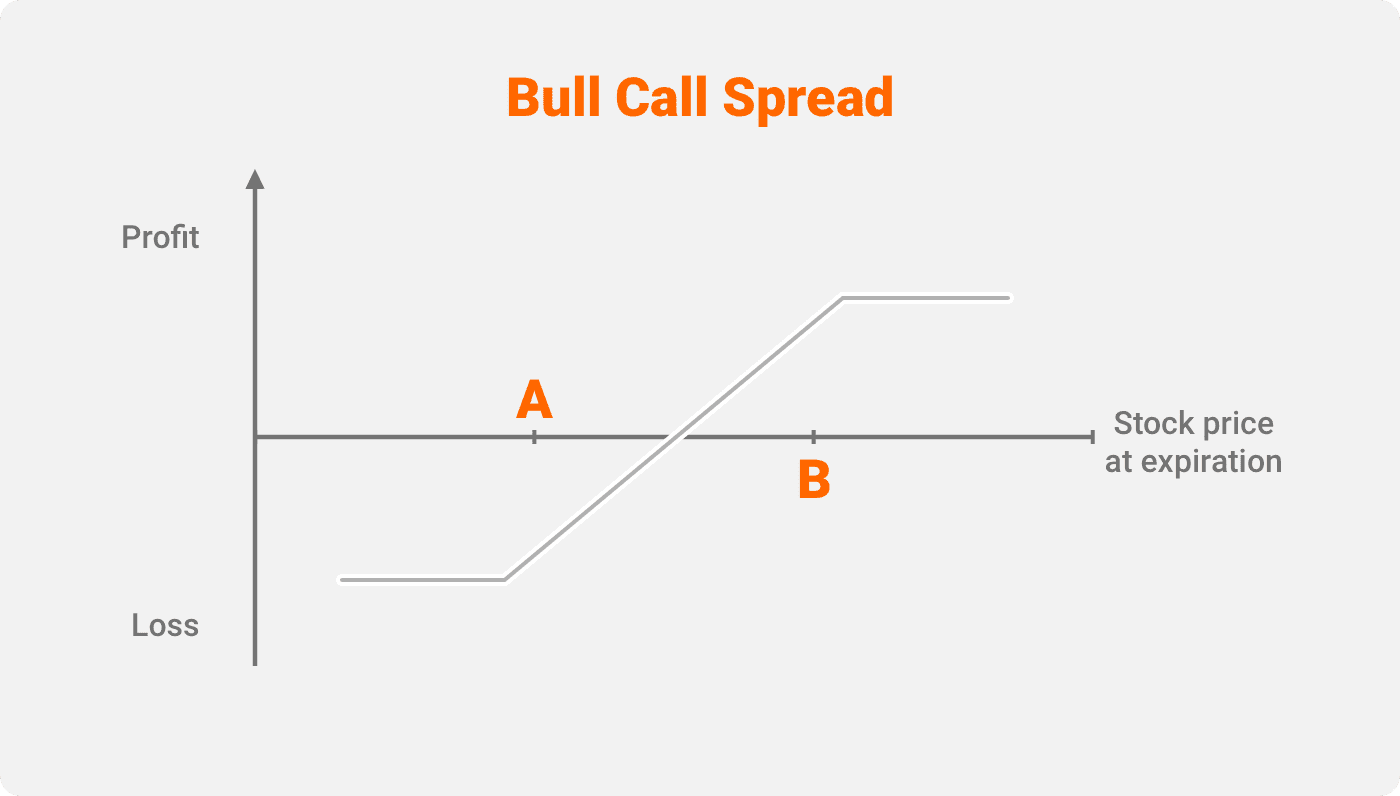

Bull call spread involves buying a call option.

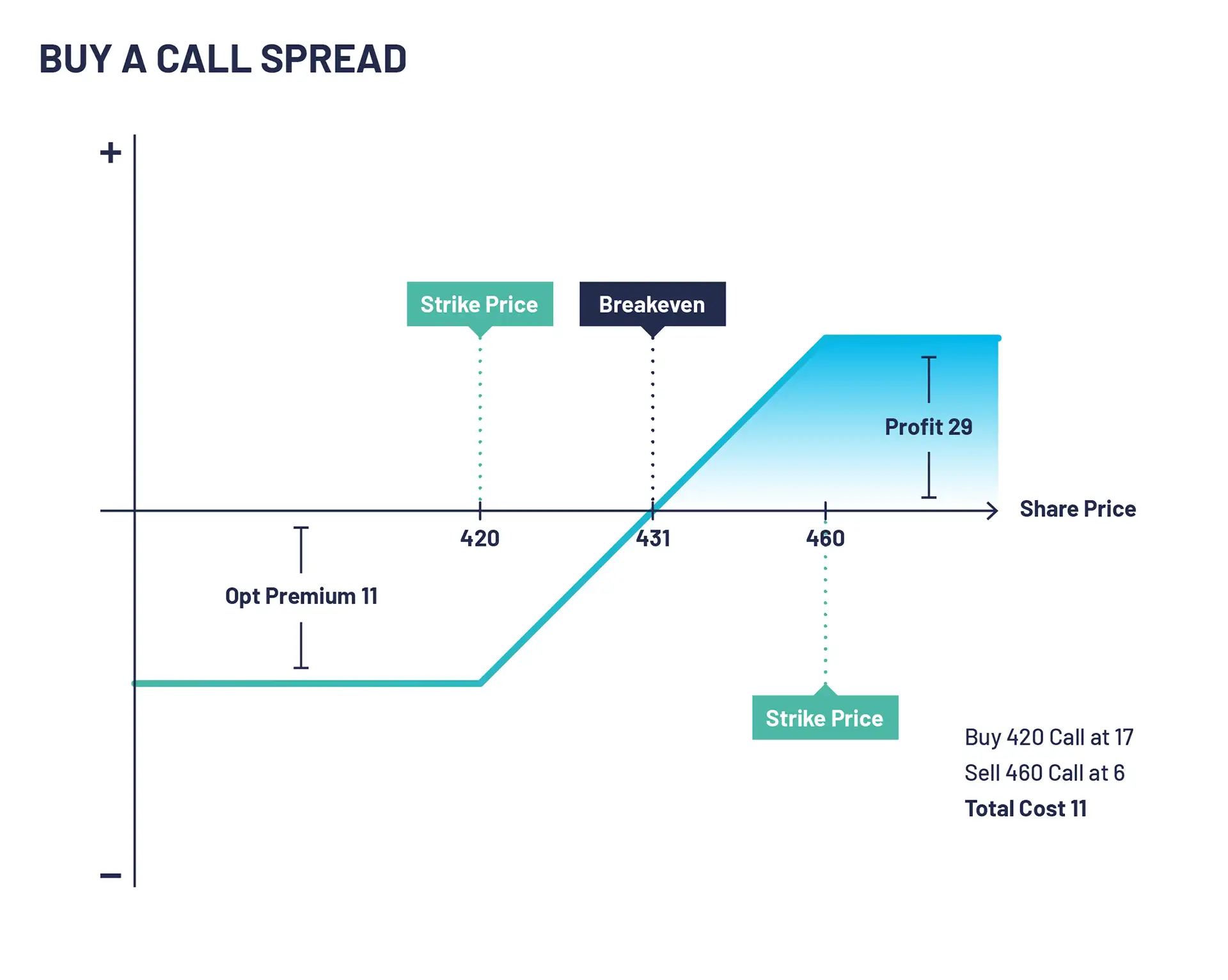

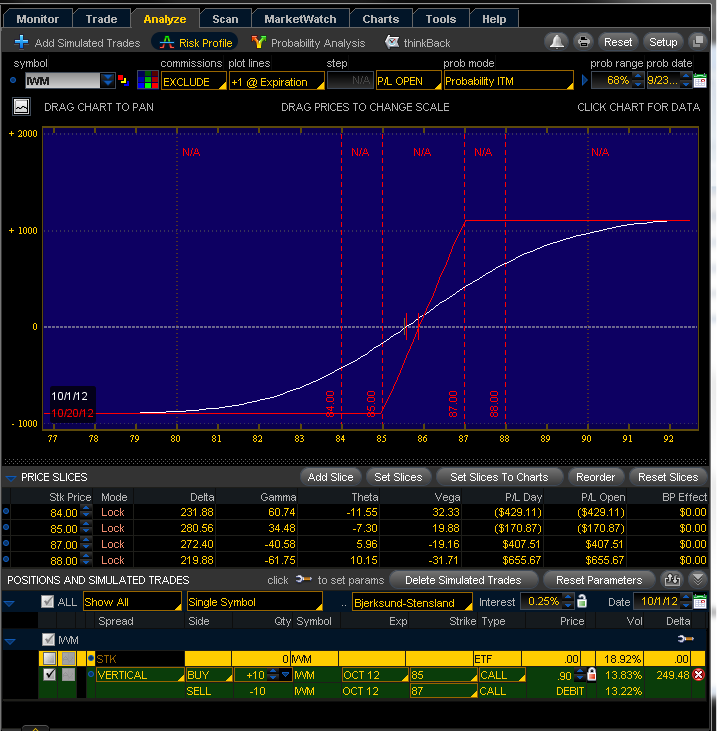

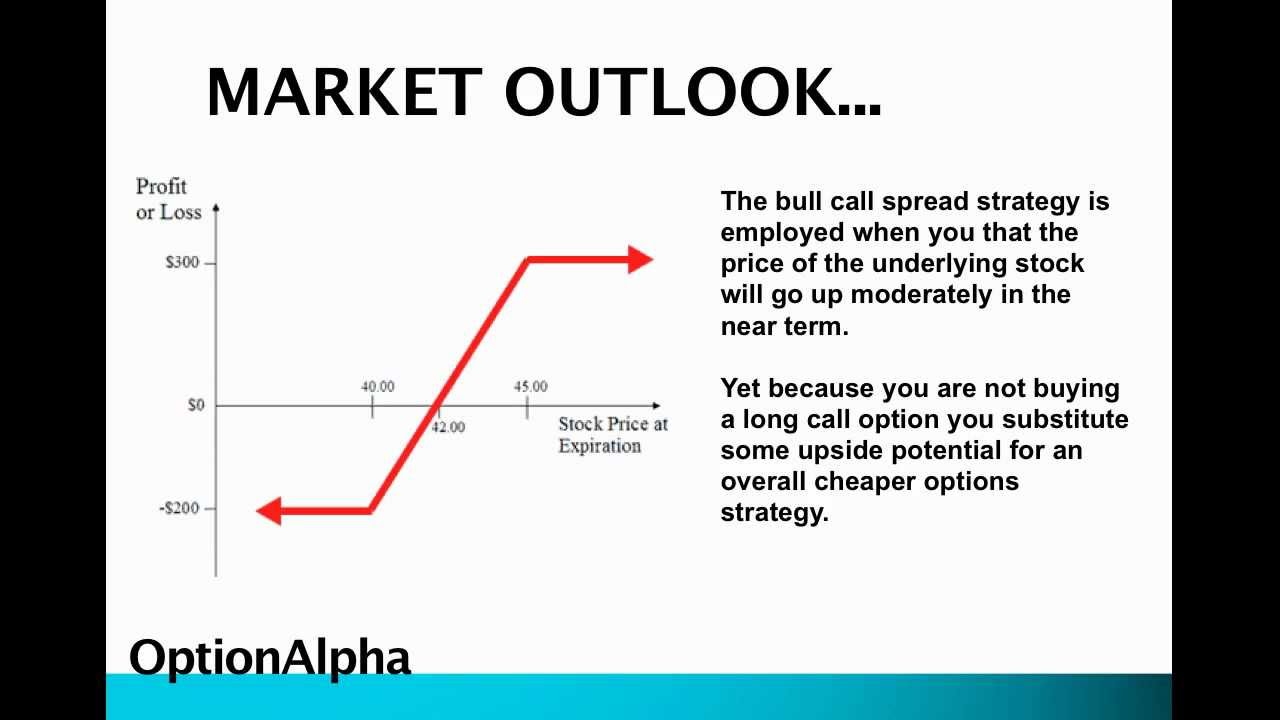

How to buy a call spread. Sell an equal number of higher strike calls with the same expiration date. Panw bullish call spread at $3.60 appears to be a good buy. A bull call spread is an options trading strategy used when the trader expects a moderate rise in the price of the underlying asset.

A bull call spread is an options strategy that a trader uses when they believe the price of an underlying stock will go up by a moderate amount in the near term. Long 1 xyz 100 call short 1 xyz 105.

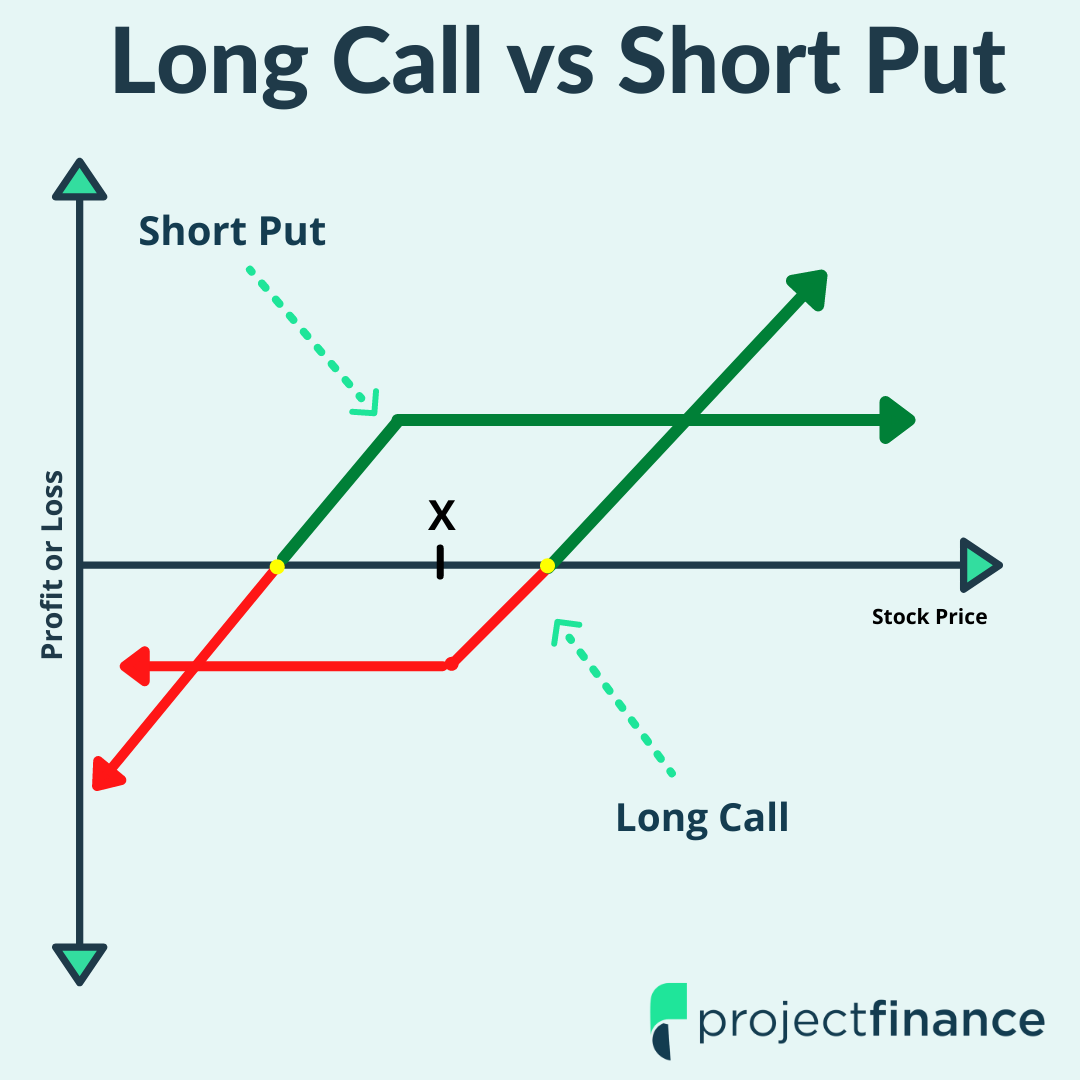

This strategy is an alternative to buying a long. Since the lower strike calls are more expensive than the higher. This gives you the right to buy stock at the strike.

Vrt bullish call spread is undervalued at $2.10. It's relatively simple, requiring just two transactions to implement, and perfectly suitable. A bull call spread is an options trading strategy used when a trader expects a moderate rise in the price of an underlying asset.

In a bull call spread strategy, an investor simultaneously buys calls at a specific strike price while also selling the same number of. Key takeaways buying calls and then selling or exercising them for a profit can be an excellent way to increase your portfolio’s performance. The bull call spread is one of the most commonly used options trading strategies there is.

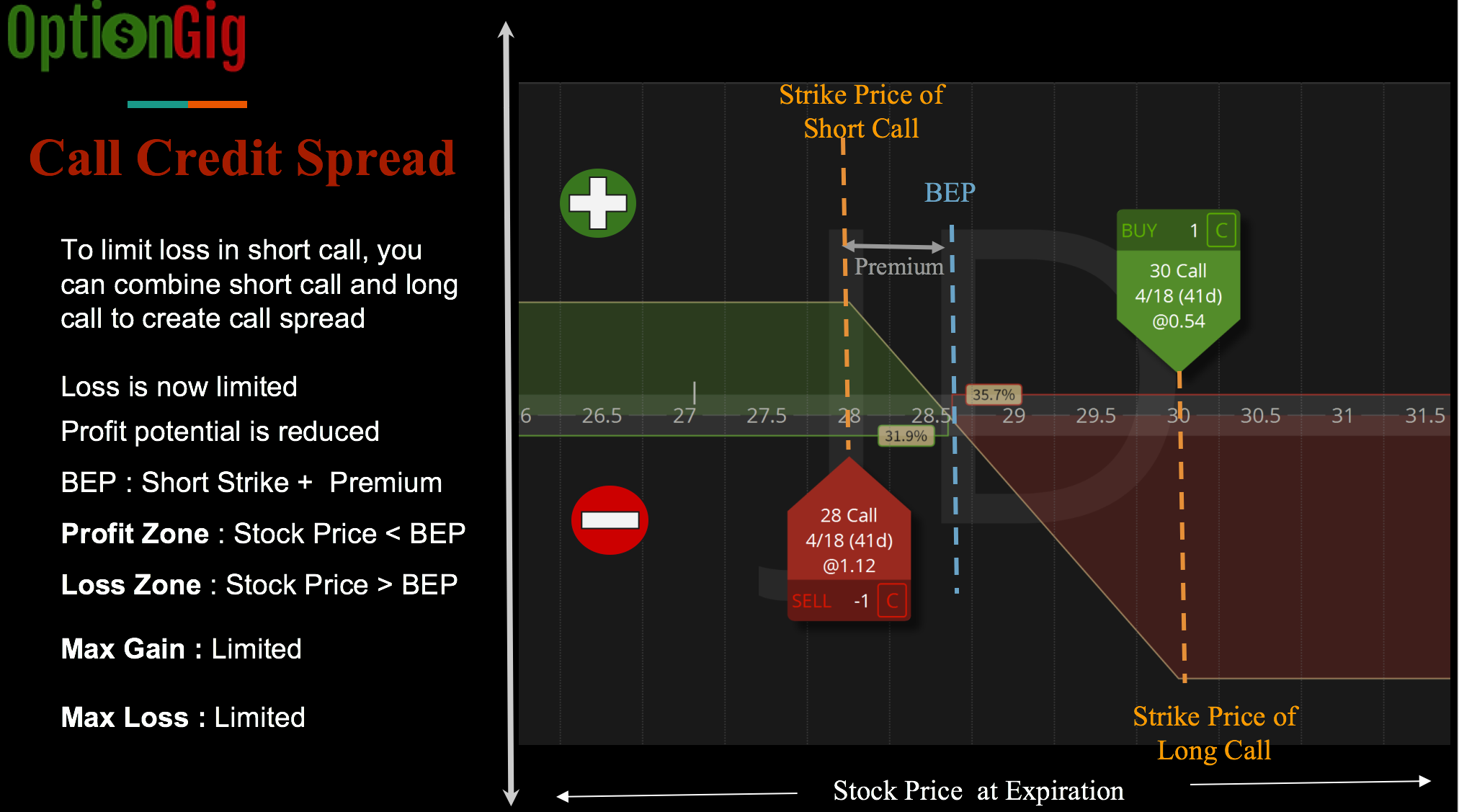

A call spread refers to buying a call on a strike, and selling another call on a higher strike of the same expiry. A bull call spread is an options strategy that is used when an investor expects a moderate rise in the price of the underlying asset. A bull call spread, also known as a long call spread, is an options strategy used to profit from a moderate rise in the price of a particular stock.

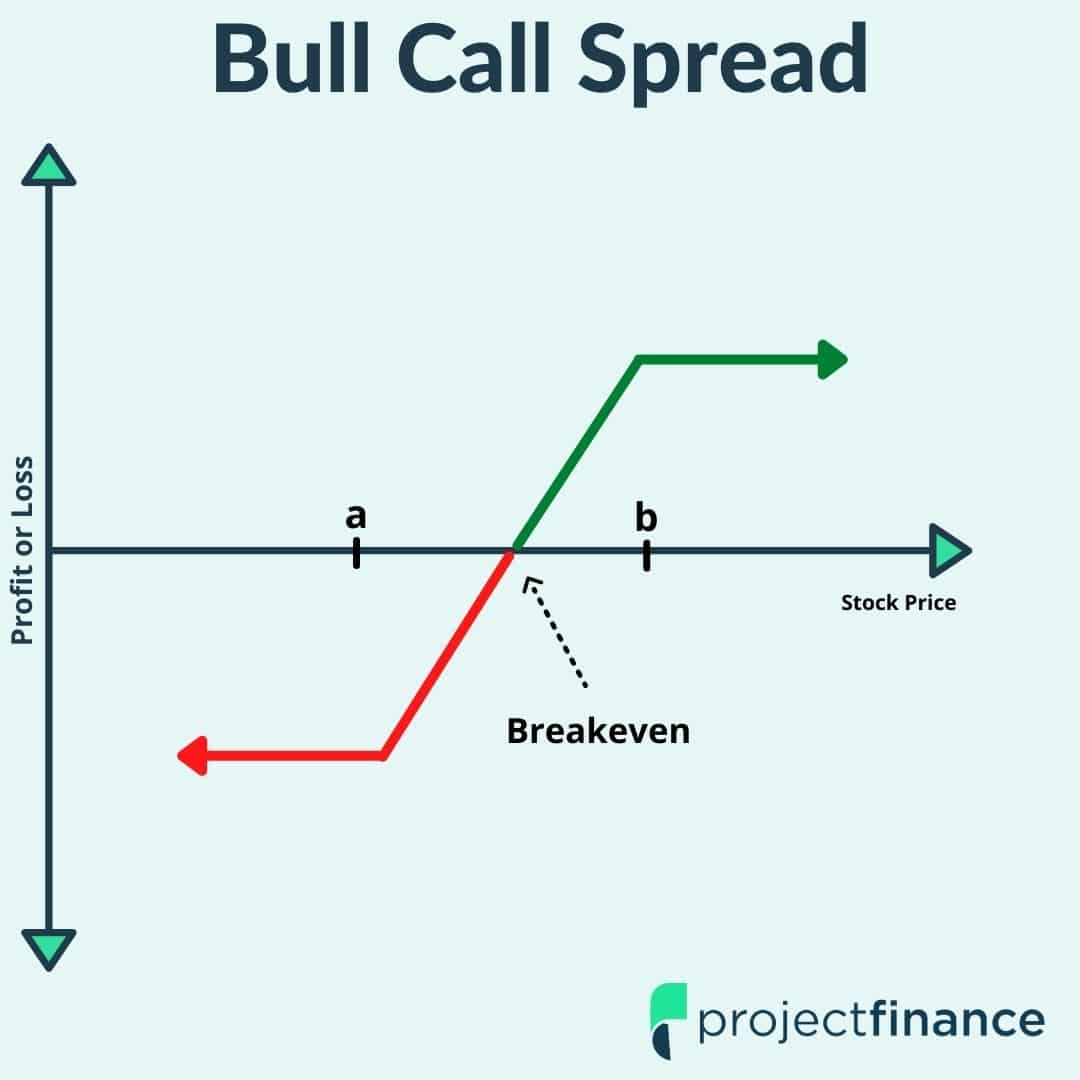

When you begin a bull call spread, you enter an order to buy to open the long call option contracts and to sell to open the short call option contracts. A long call spread gives you the right to buy stock at strike price a and obligates you to sell the stock at strike price b if assigned. Buy a lower $60 strike call.

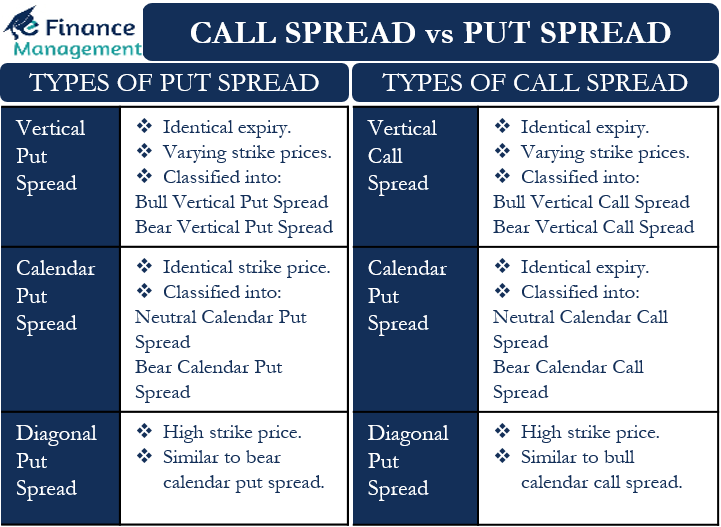

The square cash app helps individuals manage money, buy stocks and cryptocurrency, and more. A bull call spread involves buying a lower strike call and selling a higher strike call: Vertical call and put spreads so called because options with the same expiry date are quoted on an options chain quote board vertically.

This strategy involves buying a call option and. A put spread refers to buying a put on a strike, and selling another.

:max_bytes(150000):strip_icc()/bullcall-spread-4200210-1-blue-759c3882be664370823655c8d7ac9bb5.jpg)