Peerless Tips About How To Claim House Credit

If you are claiming the credit only for expenses for qualified improvements to an existing.

How to claim house credit. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. You'll calculate the credit on part i of the form, and then. Are there any requirements for how long the property must remain in use.

Just make sure you save your receipts for when you file your taxes. Final income tax = £2,400. You can't claim the credit if you're a landlord or other property.

This form explains what property qualifies for. A taxpayer may not claim the credits until the year the property is installed. Pharmacies across the united states are experiencing disruptions following a hack at unitedhealth's technology unit, change healthcare, several pharmacy chains.

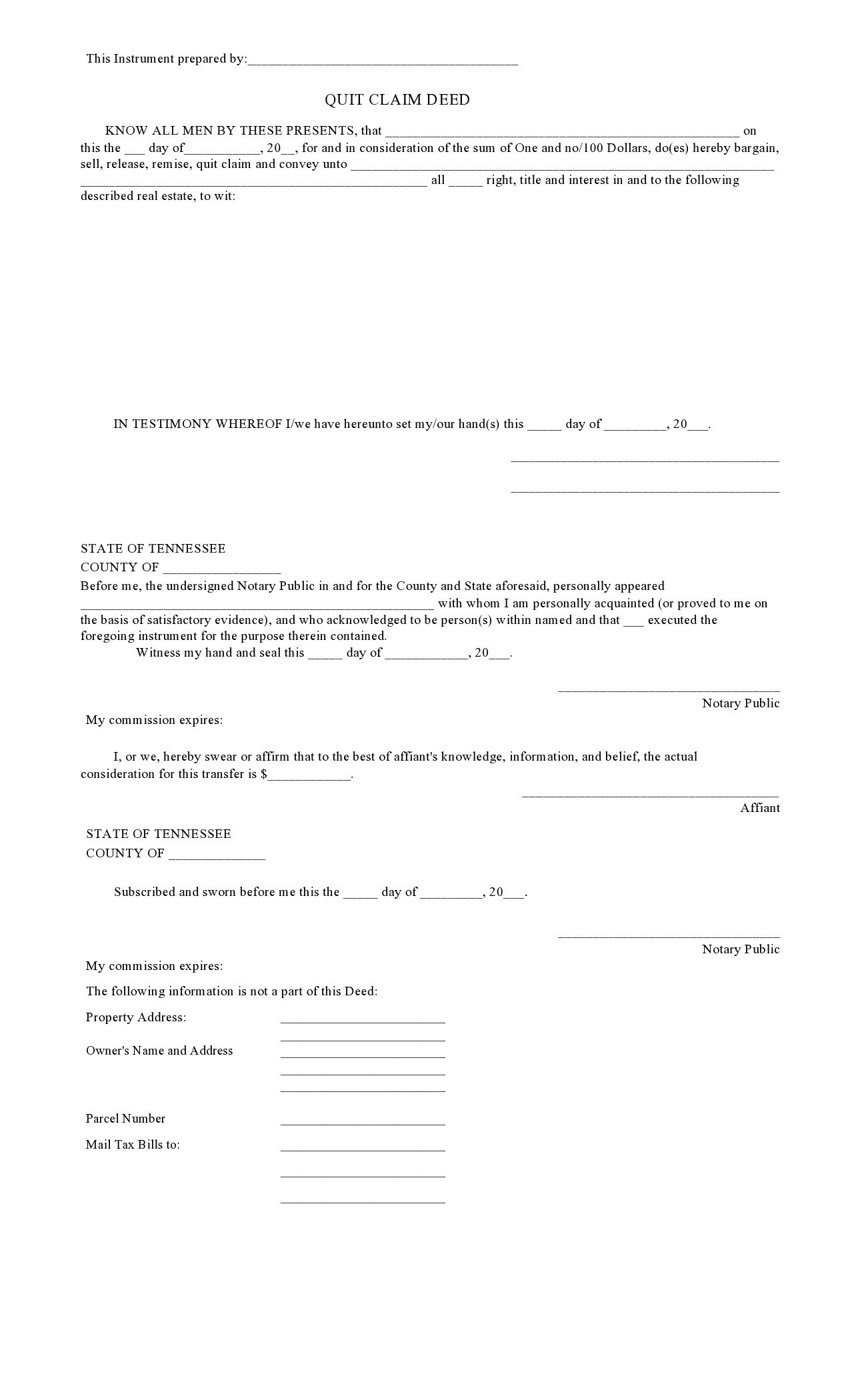

File form 5695, residential energy credits part ii, with your tax return to claim the credit. To claim the credit, you’ll need to file irs form 5695 as part of your tax return. If you’re new to universal credit, apply for universal credit.

The credit applies to new or existing homes located in the united states. You may claim the residential clean energy credit for improvements to your main home, whether you own or rent it. The new rules would increase the maximum refundable amount from $1,600 per child.

For the tax year 2024, to. Irs form 8911 may give you an idea of how much you qualify to receive as a tax credit. If you bought the house before dec.

For the tax year 2023, it would increase to $1,800; Finance costs (100% of £20,000) = £20,000. If you already get universal credit, apply for support with housing costs in your online account.

Here is a list of energy star tax credits you can claim for new home construction: Mortgage insurance (pmi or mip) unless it's a rental, you. Claiming the mortgage interest deduction requires itemizing on your tax return.

Filing requirements for the solar tax credit. Beginning january 1, 2023, the amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy. Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up to.

Your main home is generally where you live most of the time. The tax reduction is calculated as 20% of the lower of: If you just bought a house, you may be able to deduct: